|

|

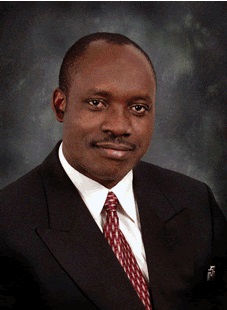

| Prof. Charles Chukwuma Soludo |

My name is Agatha. Please, permit me to leave out my last name because of the nature of the story, which I’m about to share with you.

In the 70s and early 80s, there were very few banks in Nigeria. Notable among them were First Bank of Nigeria Bank (formerly Standard Bank); United Bank for Africa (formerly British and French Bank); Union Bank (formerly Barclays Bank); African Continental Bank, National Bank, Wema Bank, Owena Bank, Savannah Bank, International Bank for West Africa, which later became Afribank and Mainstreet Bank; Societe Generale Bank, Allied Bank, Pan-African Bank, Cooperative & Commerce Bank, Bank of Industry (formerly Nigerian Industrial & Development Bank) NAL Merchant Bank, Icon Merchant Bank, and Nigerian Agricultural & Commerce Bank.

Between early 80s and 2000s came more banks. Among them were Access Bank, Commerce Bank, First City Merchant Bank, now First City Monument Bank; Guaranty Trust Bank, Zenith Bank, Diamond Bank, Eco Bank, Intercontinental Bank, Oceanic Bank, Chartered Bank, Investment Bank & Trust Company, Broad Bank and Lion Bank.

Apart from the large number of commercial and merchant banks that opened shops during those years, a large number of mortgage banks also came into operation. In short, those years can be easily described as the years of banking boom in Nigeria.

As time went by, some of those banks became distressed and unable to discharge their duties and obligations to their customers. The situation was so bad that some of their customers lost their deposits and confidence in them. Consequently, some banking directors were arrested, prosecuted and sent to jail.

Not long after those ugly developments, in 2007 to be precise, the Central Bank of Nigeria, CBN, under the leadership of Charles Chukwuma Soludo, economics professor and a former Governor and chairman of the board of directors of the Central Bank of Nigeria, CBN, felt it was necessary for banks in Nigeria to shore up their capital base in what was tagged ‘recapitalization.’ That direction was aimed at ensuring stronger banks and a better banking industry.

That order by the Central Bank of Nigeria, led to different merger and acquisition deals. While some of the banks that had what it took to recapitalize merged or combined resources with like-partners to form a single stronger bank, others who were not able to stand on their own were simply bought over by the stronger ones.

At the end of those merger and acquisition processes, the number of banks in Nigeria, which was more than fifty then, with the exception of those in the mortgage sector, was whittled down drastically to 25 stronger banks.

That made Nigeria one of the financial power-houses in Africa and led to 13 Nigerian banks to the Banker’s Magazine ‘Top 1000 world Banks’ list. As at the time of writing this article, Nigerian banks are still enjoying the dividends of consolidation, merger and acquisitions.

In a bid to remain on top and competitive, some of the banks in Nigeria now do what they call aggressive marketing. They do this by sending marketers, especially women, to scout for new customers. Such women are usually given a target; a certain amount of money they must bring in as deposit if they are to remain in their payrolls.

This strategy, from my own experience and observation, has proven to be defective. It is simply unethical. For example, some of the women used in this marketing strategy are usually caught up in the web of fornication, prostitution, adultery, and divorce.

I’ll tell you how this operates because I am a victim of this so-called strategy. Keep a date with me tomorrow.

Story By Agatha.